Volatile Market Prices of Gold and Silver Bullion

In the ever-fluctuating world of precious metals, the market prices of gold and silver bullion exhibit significant volatility. This volatility is influenced by a myriad of factors ranging from geopolitical events to economic indicators. Investors and market watchers alike are constantly seeking to understand the underlying causes of these price movements to make informed decisions. In this comprehensive article, we delve into the intricate dynamics that drive the prices of gold and silver, exploring the reasons behind their volatility and providing a detailed analysis of current trends.

Historical Context of Gold and Silver Prices

Understanding the historical context of gold and silver prices is crucial for grasping their current volatility. Gold and silver have been valued for thousands of years, serving as currency, investment, and a store of wealth. Historically, their prices have been influenced by factors such as mining supply, demand for jewelry, and their role as safe-haven assets during times of economic uncertainty.

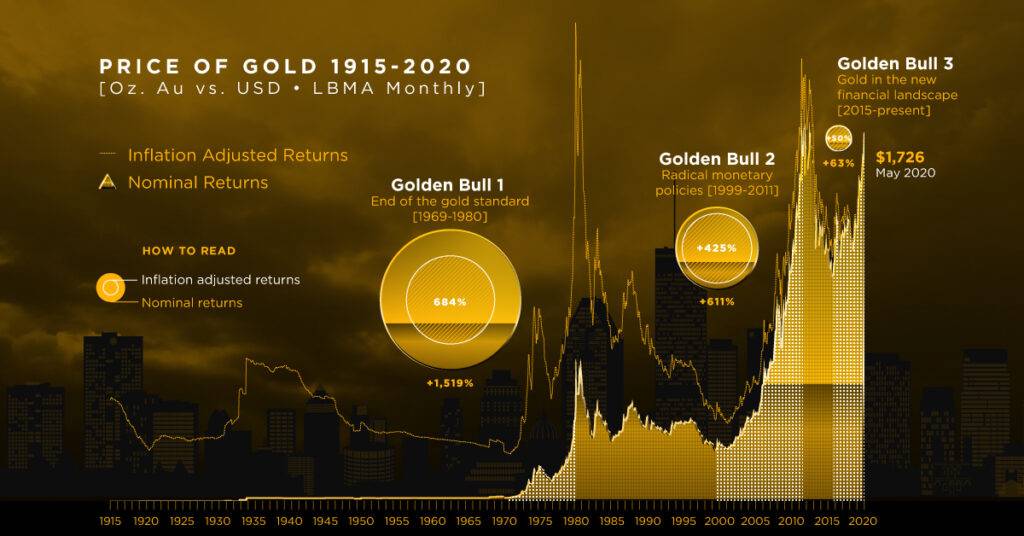

Gold Prices Over the Decades

Gold has experienced several notable price fluctuations over the decades. During the 1970s, gold prices soared due to high inflation and geopolitical tensions. The 1980s and 1990s saw a period of relative stability, followed by a significant bull market from 2001 to 2011, driven by financial crises and rising global demand. Since then, gold prices have continued to fluctuate, often in response to macroeconomic trends and investor sentiment.

Silver Price Trends

Silver, often referred to as “the poor man’s gold,” has also seen its share of volatility. Its price movements are generally more pronounced compared to gold due to its smaller market size and dual role as both an industrial metal and a precious metal. Significant price spikes occurred in the late 1970s, 2011, and more recently during the COVID-19 pandemic when industrial demand and safe-haven buying surged.

Key Factors Influencing Volatility

Several key factors contribute to the volatility in the prices of gold and silver bullion. These factors include economic indicators, geopolitical events, currency fluctuations, and market speculation.

Economic Indicators

Economic indicators such as inflation rates, interest rates, and economic growth directly impact the prices of gold and silver. Higher inflation rates generally lead to higher gold and silver prices as investors seek to protect their wealth. Conversely, higher interest rates can lead to lower precious metal prices as alternative investments become more attractive.

Geopolitical Events

Geopolitical instability often drives up the prices of gold and silver. During times of conflict, political unrest, or international tensions, investors flock to these metals as safe-haven assets. Historical events such as the Gulf War, the Brexit referendum, and ongoing Middle East conflicts have all had significant impacts on precious metal prices.

Currency Fluctuations

The value of the US dollar plays a crucial role in determining the prices of gold and silver. These metals are typically priced in dollars, so a weaker dollar makes them cheaper for investors using other currencies, thereby increasing demand. Conversely, a stronger dollar can depress prices. Central bank policies and foreign exchange rates are critical in this dynamic.

Market Speculation

Speculative trading in the commodities markets can lead to substantial price swings. Traders often buy and sell gold and silver futures contracts, betting on price movements. These speculative activities can amplify price volatility, especially in short-term trading scenarios.

Current Trends and Market Analysis

Gold Market Trends

As of 2024, the gold market is experiencing significant movements influenced by global economic recovery post-pandemic, inflation fears, and geopolitical tensions. The recent monetary policies by major central banks, including the Federal Reserve, have kept interest rates relatively low, supporting gold prices. Additionally, ongoing geopolitical uncertainties, particularly in Eastern Europe and the Middle East, continue to bolster demand for gold as a safe-haven asset.

Silver Market Dynamics

The silver market, while influenced by similar factors as gold, also faces unique dynamics due to its industrial applications. The increasing demand for silver in renewable energy technologies, such as solar panels, and in electronics, has provided a solid foundation for its price. However, supply chain disruptions and changes in industrial demand can lead to sharp price movements. Recent trends show a growing interest in silver as an investment asset, further contributing to its price volatility.

Investment Strategies in a Volatile Market

Investing in gold and silver bullion requires careful consideration of market conditions and an understanding of the factors driving volatility. Here are some strategies to consider:

Diversification

Diversification remains a cornerstone of investment strategy. By spreading investments across different asset classes, including precious metals, stocks, and bonds, investors can mitigate risks associated with volatility in any single market.

Regular Monitoring

Given the volatile nature of gold and silver prices, regular monitoring of market conditions and economic indicators is essential. Staying informed about geopolitical events, central bank policies, and economic data can help investors make timely decisions.

Long-Term Perspective

While short-term volatility can be daunting, maintaining a long-term perspective is crucial. Historically, gold and silver have preserved wealth over long periods, and their prices tend to rise during economic downturns and periods of uncertainty.

Physical vs. Paper Investments

Investors can choose between physical bullion and paper investments such as ETFs and futures contracts. Physical bullion offers the advantage of tangible ownership but involves storage and insurance costs. Paper investments provide liquidity and ease of trading but come with counterparty risks.

The volatile market prices of gold and silver bullion present both opportunities and challenges for investors. By understanding the historical context, key influencing factors, and current market trends, investors can better navigate this dynamic market. Employing sound investment strategies, including diversification and regular market monitoring, can help mitigate risks and capitalize on opportunities.

Add comment